&Green was established in 2017 as an independent investment vehicle to be a market leader in directly financing delinking deforestation in the tropics from commodity supply chains. The initial promoter was IDH Sustainable Trade Initiative, who partnered with the anchor investor, the Norwegian Climate and Forestry Initiative (NICFI) to get the idea off the ground.

Five years later and deforestation, a major driver of greenhouse gas emissions and climate change, remains high and out of control. While the levers to stop deforestation are known, the time to actually implement these , at scale, must be right now. Finance will play a critical role to solve the problem of deforestation, and &Green’s learnings are showcasing how it can be used as a tool for success.

WHAT HAPPENED AT GLASGOW?

In November 2021, delegates and world leaders from every nation gathered for the UN’s annual ‘Conference of the Parties’ summit for the 26th time: COP26 in Glasgow, Scotland. The event took place in a year of growing severity of climate change impacts, with all regions of the world experiencing record temperatures, fires, storms, flooding and/or droughts.

Accounting for 25% of global greenhouse gases, the agriculture, forestry and other land uses (AFOLU) sector is the second largest anthropogenic source of emissions after fossil fuel combustion. By 2050, c.10 billion people worldwide will need to be fed, and land use for food crops and animal feed is expected to expand significantly from an already unsustainable level. The world must halt deforestation and increase forest restoration, while reducing emissions from food production, to mitigate climate change and keep the 1.5oC target within reach.

The UK hosts characterized COP26 as “the best last chance to get runaway climate change under control”, and on the second day of the summit, 130+ world leaders (now 141) representing more than 90% of the world’s forests issued the Glasgow Declaration on Forests and Land Use, which has at its core the commitment of:

‘…working collectively to halt and reverse forest loss and land degradation by 2030 while delivering sustainable development and promoting an inclusive rural transformation.’

This was highlighted in the press and by leading conservation groups as a key step forward, but many remain concerned that no actual implementation capacity or on-the-ground willingness exist to achieve it.

SPEED AND SCALE OF THE CHALLENGE

Forests cover 31% of the world’s land area, approximately 4 billion hectares. The average annual rate of net forest loss (forest loss as well as forest gain) was 4.74 million hectares over the past decade

(2010-2020), 40% less than the previous decade, but still not a reversal of the trend and far away from the Glasgow Declaration’s target.

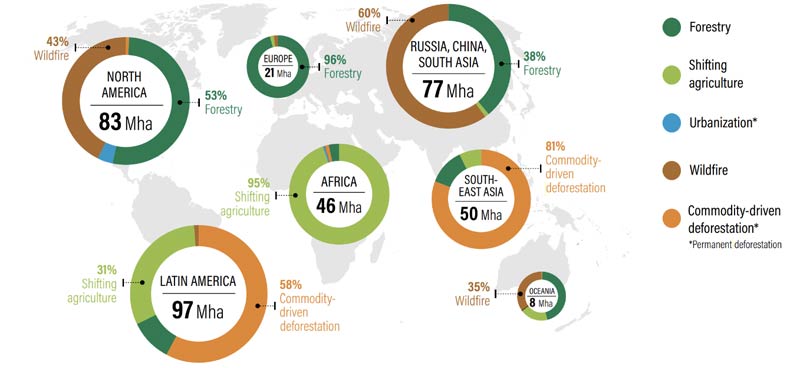

Forest loss and degradation continue at an alarming rate, mainly driven by increasing demand for agri-related products as the world population rises and becomes wealthier (see Figure 1).

Figure 1 – Regional distribution of drivers of tree cover loss, 2001–18.

Source: World Resources Institute analysis on 2020 data from Global Forest Watch.

“HEARD IT ALL BEFORE?”

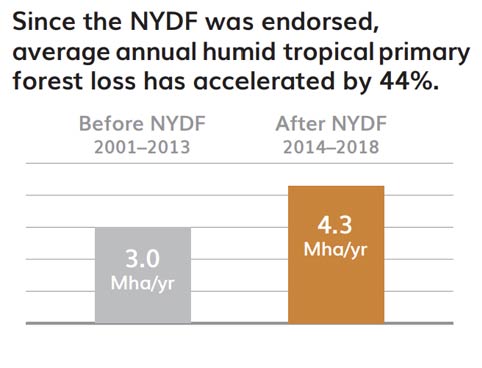

The Glasgow Declaration is an important signal, and the 2030 target is commensurate with the urgency required. However, similar declarations have been made in the past, notably the 2014 New York Declaration on Forests (NYDF), which aimed to halve deforestation by 2020 and end it by 2030. The 200 entities that signed it failed to meet the 2020 target and are evidently not on-track for the 2030 target.

Following the NYDF, tropical primary forest loss increased by 44% to an average of 4.3Mha per year in 2014–18, from an average of 3Mha per year in 2002–13 (see Figure 2).

Figure 2 – Humid tropical primary forest loss before and

after NYDF. Source: Forest Declaration Platform (2019). Progress on the New York Declaration on Forests – five year assessment report.

The conversion of forested land to other commercial land uses is an ongoing phenomenon characterized by short-term thinking related to profits, at the expenses of the long-term benefits of forest protection.

Although NYDF and Glasgow commitments share similarities, the Glasgow Declaration has greater momentum and leaves more room to be cautiously optimistic about its fruitfulness. The Declaration reinforces countries’ ability to meet their Nationally Determined Contributions (NDCs) of the Paris Agreement, which are integral to their national policies; and it emphasizes the need for governments, businesses and institutions to secure financial commitments and channel their capital towards projects that support inclusive and sustainable agriculture.

Bold and comprehensive reforms are needed to catalyze the transformation of the agricultural sector, as further stressed in the latest IPCC report. Transitioning to deforestation-free supply chains requires a shift from current extraction/expansion-based agri-models to an intensification-based approach that can ensure less land clearing and better use of existing land.

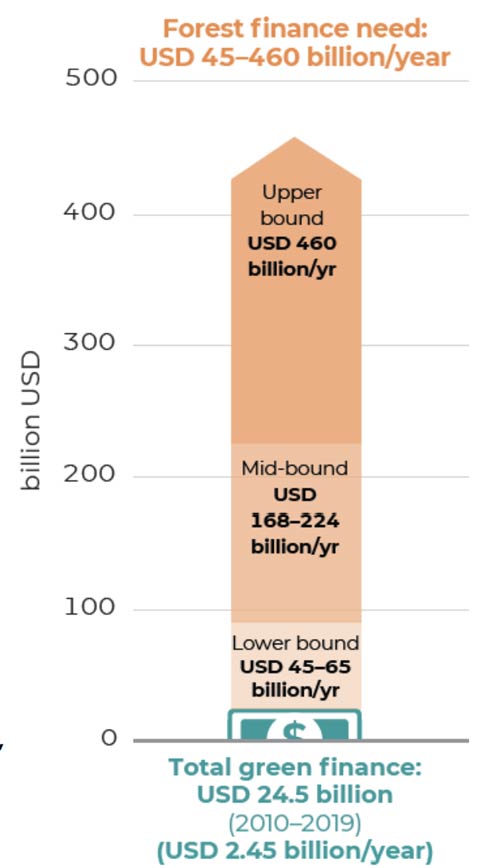

The five-year assessment report on the NYFD has estimated that it will take around USD 45-460 billion per year to achieve effective forest protection and meet the 1.5oC target (see Figure 3). Yet, between 2010 and 2019, an average of only USD 2.5 billion per year was allocated to forest protection.

The lack of finance flowing to sustainable and regenerative agriculture is a major obstacle that has slowed, and continues to slow, necessary sectoral shifts. Consequently, the Glasgow Declaration once again calls for innovative finance and more investments in the agri-sector.

Figure 3 – Forest Finance needed to meet NYDF target.

Source: Forest Declaration Platform (2022). Progress on the New York Declaration on Forests – Accelerating finance to reduce forest emissions

TRANSFORMING AND TRANSITIONING

Supply chains in tropical regions must adopt a sustainable, deforestation-free, socially inclusive business model that intensifies production to meet demand while restoring and protecting tropical forests. Sustainably intensified land will produce more food without requiring further deforestation, which will enable the conservation and restoration of natural ecosystems to protect biodiversity, and provide climate resilience and inclusive and decent work for local communities. Bringing degraded land, which amounts to 25% of the global land area, back into productivity means further deforestation is not needed and natural forest areas can (and should) be restored. This sector transformation is fundamental to protecting forests, fostering sustainable trade and development, and increasing human and ecosystems’ resilience. This is clearly recognized in the Glasgow Declaration:

‘To meet our land use, climate, biodiversity and sustainable development goals, both globally and nationally, will require transformative further action in the interconnected areas of sustainable production and consumption; infrastructure development; trade; finance and investment; and support for smallholders, Indigenous Peoples, and local communities, who depend on forests for their livelihoods and have a key role in their stewardship’

Supply chains and their investors/financiers must be willing to ‘go deep’ into determining effective ways to change current practices and investing in the needed trial-and-error (the R&D) to make changes at scale. Too little tangible evidence of this has been seen since the NYFD. Land Use Change requires actual willingness, real technology, on-the-ground expertise and the purpose-built finance to deliver it. To do this within this decade means investment needs to start now, and it needs to start where the problem lies: at the frontier of where forests meet agri-commodity supply chains.

MORE AND SMARTER FINANCE

Financing such transformations necessitates an urgent and meaningful reallocation of capital from major companies, banks, and investors into no deforestation business models. Intervening at the source of the problem is essential: the finance sector should work with established, large-scale commercial actors to change the way existing value chains do business, achieve real emissions reductions and reach key tipping points that transform entire sectors.

&Green has been doing this since 2019, learning a lot on the way, always putting transformational change as the main investment criteria for every transaction: supporting interventions with scalable impact on protecting forests, optimizing production, and empowering communities. Many studies and pilots describe theoretically how financing ‘deforestation-free’ can be done, but investors will be convinced to replicate and scale-up mainly by the success they can see in a commercial, real-life setting.

By providing long-term debt to existing and influential players in commodity production, &Green is showcasing how transforming existing supply chains at scale can be done. With several transactions in the Brazilian cattle and Indonesian palm oil sectors, &Green has demonstrated that a relatively small amount of strategic capital intelligently allocated can start shifting entire sectors.

From our experience, we see hope: Hope, that stopping deforestation can be achieved in a critical space, tropical agri-commodity production. Hope, because with supportive regulatory and market environments, the finance needed to make it happen is substantial, but not unattainable if it can be mobilized through models in which public actors de-risk commercial capital. And hope, because commodity players on the ground as well as the international finance community have acknowledged the problem, and are testing new models.

The key challenge we see is both the speed and the scale at which donors, investors, and players on the ground will raise to the challenge and turn commitment into action – using the tools and learnings made in the past years.

WHAT LIES AHEAD

This decade calls for the global financial sector to invest in and develop sustainable supply chains and introduce innovative finance instruments that can change and increase the resilience of food and land use systems. The rules of the game must change. &Green is proving that shifting from an incremental to a transformational approach is a possible and scalable solution to protect increasingly degrading forests and land use systems. There is a clear financial opportunity to do this and the combination of this with outsized climate benefits will become increasingly attractive for asset owners and managers during this decade as long as frontrunners, such as &Green, can showcase the opportunity and do so at scale.

The decisions taken on the road to 2030 will determine the future of our forests and ecosystems well beyond the next eight years. Our actions must be focused in the present, but conscious of the sustainability of our natural capital up to and beyond 2030. It is now urgently necessary to act with speed and at scale to transform the agricultural sector and protect forests, as commitments without action have proven to inevitably fail.

ANNEX: Full Text Of The Glasgow Declaration On Forests And Land Use

We, the leaders of the countries identified below:

Emphasise the critical and interdependent roles of forests of all types, biodiversity and sustainable land use in enabling the world to meet its sustainable development goals; to help achieve a balance between anthropogenic greenhouse gas emissions and removal by sinks; to adapt to climate change; and to maintain other ecosystem services.

Reaffirm our respective commitments, collective and individual, to the UN Framework Convention on Climate Change and the Paris Agreement, the Convention on Biological Diversity, the UN Convention to Combat Desertification, the Sustainable Development Goals; and other relevant initiatives.

Reaffirm our respective commitments to sustainable land use, and to the conservation, protection, sustainable management and restoration of forests, and other terrestrial ecosystems.

Recognise that to meet our land use, climate, biodiversity and sustainable development goals, both globally and nationally, will require transformative further action in the interconnected areas of sustainable production and consumption; infrastructure development; trade; finance and investment; and support for smallholders, Indigenous Peoples, and local communities, who depend on forests for their livelihoods and have a key role in their stewardship.

Highlight the areas of strong progress in recent years and the opportunities before us to accelerate action.

We therefore commit to working collectively to halt and reverse forest loss and land degradation by 2030 while delivering sustainable development and promoting an inclusive rural transformation.

We will strengthen our shared efforts to:

- Conserve forests and other terrestrial ecosystems and accelerate their restoration;

- Facilitate trade and development policies, internationally and domestically, that promote sustainable development, and sustainable commodity production and consumption, that work to countries’ mutual benefit, and that do not drive deforestation and land degradation;

- Reduce vulnerability, build resilience and enhance rural livelihoods, including through empowering communities, the development of profitable, sustainable agriculture, and recognition of the multiple values of forests, while recognising the rights of Indigenous Peoples, as well as local communities, in accordance with relevant national legislation and international instruments, as appropriate;

- Implement and, if necessary, redesign agricultural policies and programmes to incentivise sustainable agriculture, promote food security, and benefit the environment;

- Reaffirm international financial commitments and significantly increase finance and investment from a wide variety of public and private sources, while also improving its effectiveness and accessibility, to enable sustainable agriculture, sustainable forest management, forest conservation and restoration, and support for Indigenous Peoples and local communities;

- Facilitate the alignment of financial flows with international goals to reverse forest loss and degradation, while ensuring robust policies and systems are in place to accelerate the transition to an economy that is resilient and advances forest, sustainable land use, biodiversity and climate goals.

We urge all leaders to join forces in a sustainable land use transition. This is essential to meeting the Paris Agreement goals, including reducing vulnerability to the impacts of climate change and holding the increase in the global average temperature to well below 2°C and pursuing efforts to limit it to 1.5°C, noting that the science shows further acceleration of efforts is needed if we are to collectively keep 1.5°C within reach. Together we can succeed in fighting climate change, delivering resilient and inclusive growth, and halting and reversing forest loss and land degradation.

% OF FOREST COVERED BY ENDORSERS: 90.94%

HECTARES OF FOREST COVERED BY ENDORSERS: 3,691,510,640

Total: 141

1. Albania 41. Fiji | 48. Greece 52. Guyana | 97. Paraguay 102. Republic of the Congo |

NEW ENDORSEMENTS SINCE 10/11/21: The Holy See, Nicaragua, Singapore, Turkmenistan

1 https://ukcop26.org/uk-presidency/what-is-a-cop/

2 https://ukcop26.org/glasgow-leaders-declaration-on-forests-and-land-use/ , full text included as Annex.

3 State of the World’s Forests 2020 (fao.org)

4 https://www.globalforestwatch.org/blog/data-and-research/global-tree-cover-loss-data-2020/

5 2019NYDFReport_ES_EN.pdf (forestdeclaration.org)