Global production and consumption of meat have grown steadily over the past three decades due to higher levels of affluence globally, with evident negative environmental impacts.

Currently:

- Emissions from ruminants account for as much as 30% of global anthropogenic methane emissions;

- In 2021, the global cattle population exceeded one billion head, with beef being around 22% of meat consumed around the world;

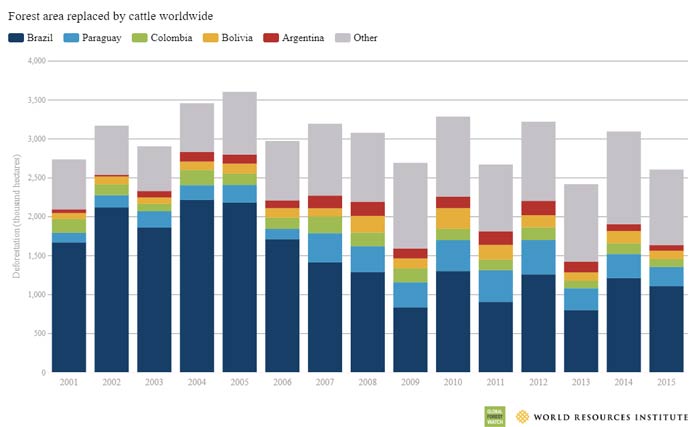

- Cattle production is a primary driver of (often illegal) deforestation, particularly in Latin America, resulting in additional greenhouse gas emissions.

Dramatic emissions reductions are required in many sectors to meet any Net Zero or 2°C targets by 2050. So why invest in sectors, such as livestock, that are major emission sources? Isn’t it deleterious to global environmental goals? Shouldn’t we rather use the same investments to fund the shifting of habits away from eating beef? Aren’t cows the new coal? This paper addresses these fundamental questions and sets out &Green’s rationale for investing in the beef sector.

WHAT’S AT ‘STEAK’?

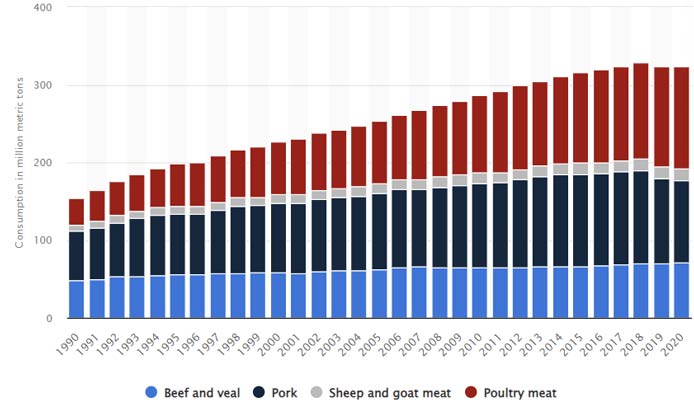

Global consumption of meat has more than doubled since 1990, reaching 324 million tons of carcass weight in 2020. Developing countries account for around 80% of this increase. Modest diet changes away from red meat have recently been seen in OECD countries; however, these are outweighed by increasing demand due to population growth and increasing wealth, leading to changes in diet (as has been similarly seen in developed countries before) in the world’s emerging economies. Higher consumption of beef products is mirrored by higher production in the cattle sector, which currently results in significant negative impacts to the environment.

Cows eat cellulosic grasses that humans cannot digest; the microbes present in cows’ digestive tracts decompose and ferment cellulose, and as a by-product, produce methane (CH4), a powerful greenhouse gas. This enteric fermentation process and the resulting emissions, are the negative climate impact which are most often linked to red meat. What is less well known is that, globally, deforestation caused by cattle production results in approximately three times the emissions that arise from enteric fermentation.

Indeed, the meat farming model is often inefficient: characterized by low productivity and extensive land use, cattle production is enabled by the low cost of deforesting new land. In the Brazilian Amazon biome, pastureland for livestock makes up nearly 80% of the land that was deforested between 1996 and 2006. And that trend has continued – if not accelerated – since then. Tropical deforestation accounts for around 20% of all global climate-warming emissions, and is disastrous for biodiversity, hydrology, and often for social structures and cohesion, particularly among indigenous peoples. The high levels of greenhouse gases emitted in beef production and the key role that animal agriculture and related land use play in climate change have contributed to the perception that cows have become the ‘new coal’. Although it is easier to just accept the statement, it is flawed.

WHAT ARE THE SOLUTIONS?

Reducing meat consumption is a self-evident climate mitigation measure. By 2050, global consumption of beef needs to reduce by at least 80% from current levels to be compatible with Net Zero. Some modest shifts away from red meat have occurred, with veganism and vegetarianism having increased significantly in some countries (mainly developed economies). Since 2018, commercially available diversified sources of protein as beef alternatives have rapidly grown though they currently have a near-zero market share, as they are typically more expensive for consumers and/or have preference and taste barriers to uptake. These two trends away from beef are particularly important in developed economies for reducing beef overconsumption. However, there is no evidence that these emerging alternatives have altered beef consumption trends in developing countries or the global trend, and it is unlikely they will have significant impact on emerging economy diets in the short term. Beef demand is forecast to increase at least until 2030, before any (slow) declines, and reductions in beef consumption are unlikely to be sufficiently rapid in this critical decade and will remain challenging in the next 30 years. It is the differences in the demand side that makes the cows vs. coal a false comparison. As long as people have access to energy, warmth, and light, they will likely not be concerned with coal being phased out and replaced by more sustainable energy sources. If people do care, they will be happy to know their energy comes from alternative, more sustainable sources. But meat is culturally prized and not directly

replaceable by other products; changing the world’s eating habits will be hard and will take a long time because people care about what they consume. Strictly relying on demand side measures will not be enough to decrease beef-related emissions and deforestation fast enough.

It appears clear that advocating and hoping for changes in consumer sentiment is not an effective mitigation strategy in the near term. If we recognize this, what else can we do?

We must reduce emissions from the sector as far and as fast as possible, while continuing to push and wait for demand side reductions to take hold over time. The beef farming model needs to be transformed at scale…and now. Stopping cattle-driven deforestation and improving efficiency in production can achieve up to 80% reduction in tCO2e per kg of beef consumed, while also having the benefits of forest protection (i.e. biodiversity, CO2 sequestration), employment, and professionalization of the sector. The Glasgow Declaration on Forests and Land Use issued during COP26 has again reminded the world of the urgent need to halt and reverse forest loss and land degradation by 2030, if we are to reach climate goals. Investing in intensification and higher productivity in the beef sector can meet the short-medium term demand growth from the same amount of land, avoiding the need for deforestation. Working with the cattle sector through systemic interventions in the beef sector can rapidly reduce deforestation and greenhouse gas emissions, while offering an attractive commercial opportunity for the sector.

TAKING ACTION

&Green generates impact in landscapes where valuable ecosystems require active protection and/or restoration, but where competing forces, specifically from agricultural production, frustrate the required actions. Following its fundamental mandate to de-link deforestation from agri-commodity production, &Green seeks to transform the cattle industry by building accountability through traceability, public commitments, and providing proof points of actual on-the-ground implementation of a higher productivity and deforestation-free approach.

&Green’s investments in beef production limit emissions in two ways: by changing the way land is used (intensification over extensification and deforestation) and the way meat is produced (efficiency over low productivity). By requiring that meatpackers and their supply chains do not deforest new land, &Green makes cattle grazing on recently deforested land less viable for farmers, supporting governments’ increasing regulations and enforcement of forest protection. Steering production away from deforestation and towards more sustainable practices de-

creases pressure on remaining natural ecosystems, and frees up land for other purposes, including forest and other ecosystem restoration. More efficient livestock farming can greatly reduce greenhouse gas emissions while boosting soil health and farmer incomes. Global red meat consumption must eventually decrease substantially to align with 2°C targets. However, demand continues to rise, and reductions in the global appetite for beef will take time. Time that the climate and biodiversity of our planet cannot afford. Engagement is needed from all stakeholders on both the demand and the supply side of the meat value chain. By working with the beef sector, large-scale and near-term emissions reductions can be achieved through halting deforestation and higher efficiency of production. This is something the financial sector can directly contribute to. &Green has already invested nearly USD 50 million into the sector in recent years and plans to increase that further to support this transition. A deforestation-free, more sustainable cattle sector by 2030 is an essential part of the climate transition and &Green aims to play a role in achieving this.

1Methane is 28-34 times as potent as CO2 on a 100 year time horizon.

3 Pigs and chickens (2019) – Department of Agriculture and Water Resources; Red meat consumption declines in several EU countries – Euromeatnews.com

4 The Rise of Vegan and Vegetarian Food – Euromonitor.com, • Share of vegans worldwide by select country 2021 – Statissta

5 Meat substitutes include plant based meat substitutes; proteins from insects, algae and worms; and proteins grown in the laboratory or “clean meat”; Global: meat substitute consumption 2013-2026 – Statista

6 Reflecting global emissions profiles, where developing country emissions are expected to continue to increase into the 2030s, before declining (the so-called ‘overshoot’).